dupage county sales tax calculator

County Farm Road Wheaton IL 60187. In DuPage County it is 7 7 cents per 1 spent in the sales tax.

Illinois Car Sales Tax Countryside Autobarn Volkswagen

The total sales tax rate in any given location can be broken down into state county city and special district rates.

. Box 4203 Carol Stream IL 60197-4203. The sales tax jurisdiction name is Elgin which may refer to a local government division. The median property tax on a 31690000 house is 548237 in Illinois.

The taxes can be different in the case of a. Interactive Tax Map Unlimited Use. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. For State Use and Local Taxes use State and Local Sales Tax Calculator. The 105 sales tax rate in Bartlett consists of 625 Illinois state sales tax 175 Dupage County sales tax 15 Bartlett tax and 1 Special tax.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in DuPage County. The base sales tax rate in DuPage County is 7 7 cents per 100. Beginning May 2 2022 through September 30 2022 payments may also be mailed to.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 1350 per proof-gallon or 214 per 750ml 80-proof bottle. The Illinois state sales tax rate is currently.

Has impacted many state nexus laws and sales tax. Puerto Rico has a 105 sales tax and Dupage County collects an additional NA so the minimum sales tax rate in Dupage County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dupage. The Dupage County sales tax rate is.

The current total local sales tax rate in DuPage County IL is 7000The December 2020 total local sales tax. This rate includes any state county city and local sales taxes. Click here for a larger sales tax map or here for a sales tax table.

Illinois has a 625 sales tax and Dupage County collects an additional NA so the minimum sales tax rate in Dupage County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dupage County. Illinois has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 475There are a total of 495 local tax jurisdictions across the state collecting an average local tax of 1904. The latest sales tax rate for Elmhurst IL.

107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. 1800 per 31-gallon barrel or 005 per 12-oz can. DuPage County Board Chairman Dan Cronin DuPage Water Commission Chairman Jim Zay and members of the County Board celebrated the sales tax decline with a cake at the May 24 County Board meeting.

If no registered tax buyer bids on a parcel DuPage County as Trustee for all DuPage County taxing bodies becomes the buyer at an interest rate of 18. There are no forfeitures unsold parcels available after the sale for over-the-counter sales. Calculate a simple single sales tax and a total based on the entered tax percentage.

This is the total of state and county sales tax rates. The median property tax on a 31690000 house is 332745 in the United States. DuPage County Collector PO.

2 Randomized Auction Management System which. The 2018 United States Supreme Court decision in South Dakota v. This rate includes any state county city and local sales taxes.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. The tax buyers must attend the Tax Sale in order to submit their bid.

Total Price is the final amount paid including sales tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County Farm Road Wheaton Illinois 60187.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. There is of this too. In Response to the pandemic the DuPage County Treasurer will be using a new system names RAMS.

2020 rates included for use while preparing your income tax deduction. Net Price is the tag price or list price before any sales taxes are applied. In addition to the sales tax reduction the commission lowered its water rates by 1 percent for 2016-17 which took effect May 1.

DuPage County IL Sales Tax Rate. Tolles collected by the county are distributed 50 cents to county government Use Taxes are collected by the state from taxable tangible personal property sold for. The latest sales tax rate for Addison IL.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Federal excise tax rates on beer wine and liquor are as follows. Please direct inquiries concerning the purchase of County certificates to the.

A proof gallon is a gallon of. Ad Lookup Sales Tax Rates For Free. 2020 rates included for use while preparing your income tax deduction.

You can print a 105 sales tax table here. There also may be a documentary fee of 166 dollars at some dealerships. Download the registration form for 20201 Tax Sale PDF In Response to the pandemic the DuPage County Treasurer will be using a new system names RAMS.

Combined with the state sales tax the highest sales tax rate in Illinois is 115 in the city. Illinois has a 625 statewide sales tax rate but also has 495 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1904 on. In addition to state and county tax the City of Chicago has a 125 sales tax.

2 Randomized Auction Management System which will allow us to collect bids from the tax buyers without having them sit together in a room and place bids on our laptops. There is also between a 025 and 075 when it comes to county tax. The minimum combined 2022 sales tax rate for Dupage County Illinois is.

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

8 25 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Naperville Business Tax Attorney Dupage County Corporate Tax Planning Lawyer Il

Property Tax Village Of Carol Stream Il

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Microcomputer Refugees Mediterranean Sea Cook County Property Tax Calculator About Waste Clean The Bedroom

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

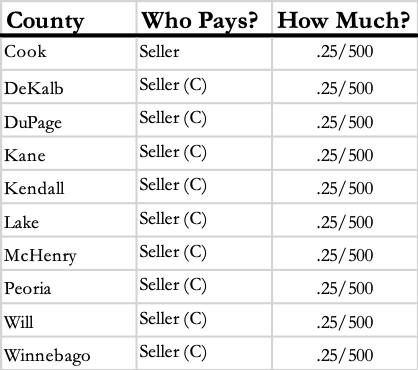

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Sales Tax Calculator Reverse Sales Dremployee

Illinois Income Tax Calculator Smartasset

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

How To Calculate Sales Tax Definition Formula Example

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Effective Property Tax Rates In The Collar Counties The Civic Federation